What is a 50/50 car insurance claim? (Guide + How To Appeal)

In a 50/50 car insurance claim, the insurance company determines that liability or fault for the accident is shared equally between both drivers. If both parties in a 50/50 at-fault accident agree that they're liable for the accident, this is called a split liability agreement.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Dec 11, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Dec 11, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If you get in an accident, your insurance company will decide on a fault determination (who is at fault for the accident). This determination can work in a variety of ways. An accident can be at-fault, not at fault, 50/50 fault, or any range of percentages in a comparative negligence state. Depending on where you live, this could determine if you could be sued, if your insurance premiums go up, and much more.

What is a 50/50 at-fault accident? Is a 50/50 car insurance claim the same thing as a split liability agreement? Can you be 50% at fault in an accident, or is one party always a bigger contributor?

The fault determination, comparing car insurance coverage you carry against the other driver’s will decide who pays for the claim and how.

Determining who is at-fault for a car accident and how it affects an insurance claim can be confusing. We can clear it up for you. We’ll break down the different fault laws, how they apply, and what to expect in a 50/50 claim for a car accident.

Read on to learn more about 50/50 car insurance claims.

What is a split liability agreement?

After a car insurance company investigates a claim, each party involved in the car accident will be assigned a percentage of liability in the accident. It’s very common for both parties to be assigned some percentage of the fault. If it is a 50/50 at-fault accident, and both parties agree on their share of the fault, it is called a split liability agreement. This means in some ways, each party is fully responsible for their car damage and injuries, no more, no less. This makes it simpler for your own auto insurance policy to handle your claim.

In the insurance world, an at-fault accident is one where the liable party has been deemed to be 51% or more to blame for the incident. A not-at-fault accident is defined as one where the liable driver was found to be 49% or less to blame for the resulting damages or injuries. Going 50/50 can translate into both parties being considered at-fault by their own insurance company. Depending on your record and the accident, an accident forgiveness program could kick in.

Enter your ZIP code below to compare car insurance company rates.

Secured with SHA-256 Encryption

What happens in a 50/50 claim?

A 50/50 liability insurance claim is when an insurance company determines that liability or fault for the accident is shared equally between the drivers. The official term for a 50/50 car insurance claim — once the representatives have determined liability — is a split liability agreement. A split liability car insurance claim says that you and the other party were equally responsible for the accident and the damage that was caused.

Maybe you made the smallest mistake while driving, but even a minor contribution can lead to a 50/50 claim if your actions could have prevented the accident from happening entirely. In most accidents, there’s some split. This just draws a line to control costs after auto accidents.

How is a car insurance claim settled?

The way a car insurance claim is settled is based on fault and depends entirely on the state that you live in. As explained by Claims Journal, there are contributory negligence states and comparative negligence states, and the percentage of fault is more important during subrogation in contributory negligence states.

In a contributory negligence system, if you’re at fault, even in the slightest, you cannot receive compensation. With a comparative negligence system, depending on what percentage you’re responsible for, you may or may not receive compensation.

In this type of case, personal injury attorneys would not be involved no matter which state you live in. Simply put, there’s no way to assign majority blame to the other party. So there’s no reason for either driver to sue or make a claim with the other party’s insurance company. Safe drivers may see more benefit than those with a few marks on their belt.

Let’s find out how your negligence can affect your ability to recover personal injury compensation.

What does a 50/50 accident look like?

There are dozens of scenarios that constitute a 50/50 at-fault car accident. Maybe you were doing an illegal U-turn when the other driver ran a red light. Perhaps you were speeding when the other driver decided to switch lanes with no warning.

If you are found to be just as responsible for the accident as the other party, you might be wondering how your car insurance claim will be paid.

What happens if you’re found to be 50% at fault?

In most situations, when you’re found to be 50% at fault for an accident, you will only be able to collect 50% of the value of your claim. If you have medical bills, the other party’s insurance will pay for half of your bills. You must pay the rest with your medical payments coverage or your health insurance.

If you have repair bills for your vehicle and you have collision coverage, you may have to pay 50% of your deductible. If you don’t have collision insurance, you’ll have to pay for half of your repairs with your own money, because the other party’s insurance will only pay for half of the damages incurred.

This can become a complicated situation when the difference of just 1% could mean that you will have to pay thousands out-of-pocket for your medical bills and repair bills. This is why it’s important to follow your claim closely and to find out why you were allocated 50% of the fault.

How is fault determined in a car accident?

Insurance companies, not police officers, determine who’s at-fault in a car accident. A citation given out by a police officer is not the deciding factor in who is at-fault in an accident, though the adjuster will take any citations issued into account when making their determination.

Do you wonder how car insurance claims work or how adjusters determine who is at fault? When you file a car insurance claim, you’re asked about the events that led up to the incident. The claims adjuster or representative that takes your initial call will ask you when the accident happened, whether or not anyone was injured, and where your vehicle is located.

You may also be asked for a police report number and the contact information of third-parties and witnesses. You will be told about the claims process and when you should expect a call to make your official statement, which will be reviewed during the claims investigation.

How do car insurance claims work?

It is only natural to feel all shaken up following an accident. This is why it is very common for claims adjusters to wait a few days for you to settle your nerves before taking your recorded statement. As an insured party in the accident, you will only speak with your own car insurance company.

The insurer will act as your middleman and speak with the claims adjuster of the other party involved for you. When the statement you give and the statement given by the third-party are reviewed, the claims department will make a determination.

What information do car insurance claim adjusters need?

After a car accident, you should contact your insurance company immediately. Your insurance company will assign a claims adjuster to your case, and they might come straight to the scene of the accident, or they might review the damages the next day.

Here are common questions car insurance claim adjusters ask:

- When did the accident take place?

- Where did the accident happen?

- Who was involved?

- Did you have passengers in your car?

- How did the accident happen?

- Whose fault do you think it was?

- Which direction were you heading?

- How many cars were involved?

- Did you file a police report?

These questions are general. They might ask other, more detailed questions, depending on the circumstances. They will also look at police reports to get an objective view of what happened and at photos from both drivers to view the damage done to each vehicle. If one driver admits fault, the insurance adjuster will take that into consideration during the investigation.

Enter your ZIP code below to compare car insurance company rates.

Secured with SHA-256 Encryption

Will my insurance go up with a 50/50 car insurance claim?

Having your car insurance rates go up after an accident is not ideal. Sometimes car insurance companies will be forgiving, and with just one accident on your driving record, you may not experience higher rates.

If you do experience higher rates after a car accident, it could be because your insurance company thinks of you as a high-risk driver.

When your car insurance rates increase after an accident that is your fault, it’s called a surcharge. A surcharge is a fee that is added to your insurance premium after you’re found at fault for a car accident. Surcharges can remain on your insurance policy for several years.

The table below, featuring data from Quadrant Information Services, shows insurance rates based on a clean driving record compared to a driving record with one accident.

| Group | Clean Record | With 1 Accident |

|---|---|---|

| USAA | $1,933.68 | $2,516.24 |

| Geico | $2,145.96 | $3,192.77 |

| American Family | $2,693.61 | $3,722.75 |

| Nationwide | $2,746.18 | $3,396.95 |

| State Farm | $2,821.18 | $3,396.01 |

| Progressive | $3,393.09 | $4,777.04 |

| Travelers | $3,447.69 | $4,289.74 |

| Farmers | $3,460.60 | $4,518.73 |

| Allstate | $3,819.90 | $4,987.68 |

| Liberty Mutual | $4,774.30 | $6,204.78 |

Even if you are not at fault for the car accident, it’s still possible for your car insurance rates to go up. You have the option to shop around for a new car insurance policy if you’re not happy with your new rates.

Fault or No-Fault Accidents

Sometimes an accident will happen in which you did nothing wrong. In that case, the other driver will usually be considered 100% at-fault for your damages and injuries. This only happens when there was nothing you could have done to prevent the collision from happening.

If the other driver is found to be 100% liable, all of your damages will be paid for by the other person’s car insurance provider, as long as you live in a state that operates under tort law.

What if it’s unclear who was at fault in a car accident?

When it’s unclear who was responsible for the accident, car insurance companies assign fault based on the state law of comparative negligence or contributory negligence. They will then determine what percentage of the accident was your fault.

Additionally, in a 50/50 car accident, you pay the excess, the amount when you make a claim on your car insurance. This amount will be refunded if you’re found to not be at fault. Your insurance company claims the car accident excess back from the at-fault party’s company, along with other costs.

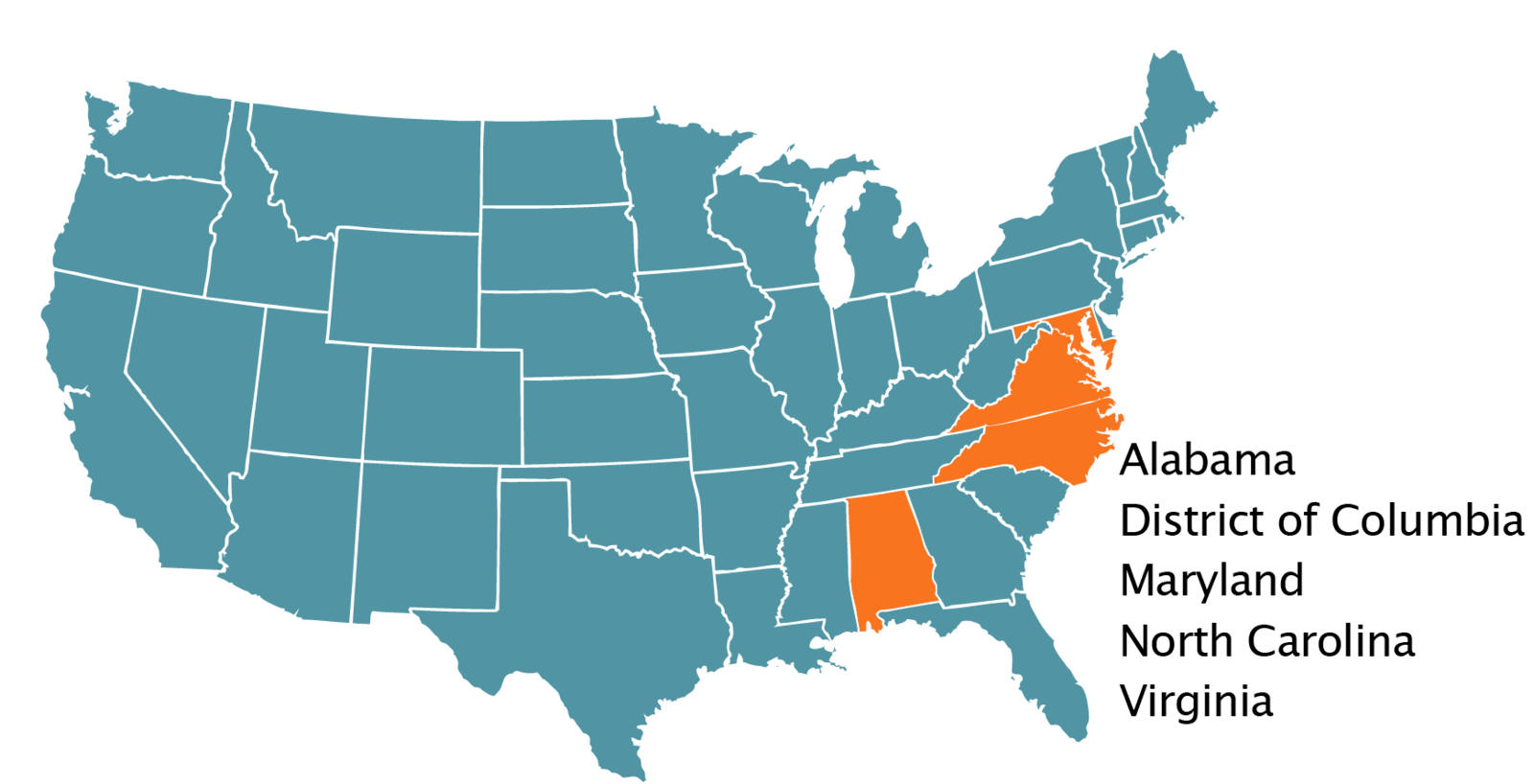

Below are the different fault systems for each state.

| Pure Contributory Negligence | Pure Comparative Negligence | Fault Comparative Negligence (51%) | Fault Comparative Negligence (50%) |

|---|---|---|---|

| Alabama | Alaska | Arkansas | Connecticut |

| District of Columbia | Arizona | Colorado | Delaware |

| Maryland | California | Idaho | Georgia |

| North Carolina | Florida | Kansas | Hawaii |

| Virginia | Kentucky | Maine | Illinois |

| Louisiana | Nebraska | Indiana | |

| Mississippi | North Dakota | Iowa | |

| Missouri | Tennessee | Massachusetts | |

| New Mexico | Utah | Michigan | |

| New York | West Virginia | Minnesota | |

| Rhode Island | Montana | ||

| Washington | Nevada | ||

| New Hampshire | |||

| New Jersey | |||

| Ohio | |||

| Oklahoma | |||

| Oregon | |||

| Pennsylvania | |||

| South Carolina | |||

| Texas | |||

| Vermont | |||

| Wisconsin | |||

| Wyoming |

According to Cornell Law School’s Legal Information Institute, most states have a modified comparative negligence system. States that operate under tort law are at-fault states. The party responsible for the damages in a car accident will pay for them in that case.

If you’re in a no-fault state, where people recoup from their own insurance company, your Personal Injury Protection will pay for your medical bills, but you can still file a claim on the other driver’s insurance for the damage to your property, and in some cases for other damages. Below you can see which states are at-fault and which are no-fault states according to data from HG.org Legal Resources.

| Fault | No-Fault |

|---|---|

| Alabama | Florida |

| Alaska | Hawaii |

| Arizona | Kansas |

| Arkansas | Kentucky |

| California | Massachusetts |

| Colorado | Michigan |

| Connecticut | Minnesota |

| Delaware | New Jersey |

| Georgia | New York |

| Idaho | North Dakota |

| Illinois | Pennsylvania |

| Indiana | Utah |

| Iowa | |

| Louisiana | |

| Maine | |

| Maryland | |

| Mississippi | |

| Missouri | |

| Montana | |

| Nebraska | |

| Nevada | |

| New Hampshire | |

| New Mexico | |

| North Carolina | |

| Ohio | |

| Oklahoma | |

| Oregon | |

| Rhode Island | |

| South Carolina | |

| South Dakota | |

| Tennessee | |

| Texas | |

| Vermont | |

| Virginia | |

| Washington | |

| West Virginia | |

| Wisconsin | |

| Wyoming |

As you can see, the majority of states operate under tort law.

What is a tort state?

A tort state is different from a state that has a no-fault insurance law. In tort states, an accident will be analyzed to determine who was responsible. The driver that caused the accident will have to pay for the damages they caused to the other driver’s car. Sometimes the fault is placed on two people. In states with tort law, you’ll need to carry liability insurance to cover any bodily injury or property damage you might cause.

If you’re at-fault under a tort system, drivers will be able to sue you for damages, medical bills, and loss of wages. Under limited tort law, you may not be able to sue the driver at-fault.

Enter your ZIP code below to compare car insurance company rates.

Secured with SHA-256 Encryption

What is no-fault insurance law?

Under no-fault car insurance law, you will have to file a claim with your own car insurance company after an accident. It doesn’t matter who caused the accident. If you live in a state with no-fault insurance laws, you’re allowed to sue for severe bodily injuries, pain and suffering, and other potential losses, but only in certain conditions.

In a no-fault state, a 50/50 car insurance claim would not be applicable. You will have to file a claim with your own insurance company to receive compensation for the damages to your car.

It’s important to note that no-fault laws generally only apply to injuries. In most cases, property damage is not part of the no-fault insurance system. It’s also vital to note that even in a no-fault state, car insurance companies will still determine fault, and the at-fault driver will still see a rate increase as a result.

There are only twelve states that have no-fault laws.

If you’re not sure whether you live in a tort state or no-fault state, check your state insurance laws. The law will also tell you what kind of insurance you need to purchase. For example, if you live in a tort state, you will need to have liability insurance coverage. If you’re in a car accident and you’re determined to be at-fault, your liability insurance will pay for the damages (up to your coverage limit).

What is comparative negligence?

Some states have comparative negligence laws pertaining to car insurance claims. When this is the law, you may not receive full compensation for your damages, depending on what degree you were found to be at-fault for the accident.

In states where this law is relevant and there is an allocation of fault, the payment might be apportioned based on the percentage of fault. This means that you may only receive 75% of the payment for your car damages, in which case you’d have to pay the remaining 25% of the damages out-of-pocket.

A pure comparative negligence system lets you receive payment from a party even if you’re at fault. For example, if you’re found to be 60% at-fault for the accident, you can still receive 40% compensation for your damages. Below are the states with a pure comparative negligence system.

For states with a modified comparative negligence system that uses the 51% bar rule, if you are more than 50% at-fault, you may not receive compensation. If you’re responsible for 50% or less, you can receive compensation. For states that use a modified comparative system with a 50% bar rule, if you’re found 50% at fault, you cannot receive compensation; you would have to be found 49% or less at-fault to receive payment.

What is contributory negligence?

States that have contributory negligence laws have more strict rules for negligent parties. Many times, these laws only pertain if you take the personal injury claim to court instead of settling with the insurance company.

The contributory negligence law says that if you are even 1% at fault for the accident, you have no chance of receiving compensation. Below are the states that use a contributory negligence system.

By contributing to the cause of the accident, you cannot recover any losses.

Enter your ZIP code below to compare car insurance company rates.

Secured with SHA-256 Encryption

How to Appeal 50/50 Car Insurance Claims

If you are wondering how to dispute a 50/50 insurance claim, you are not alone.

If you do not agree with the fact that your car insurance company found you to be 50% at fault, you do have rights. Knowing these rights can make a difference in the overall matter if you exercise them. If you don’t agree with the assessment of fault, you can speak with the adjuster’s supervisor for an explanation or you can appeal the decision.

You will likely need to file an appeal with the insurance company in writing. You will need to be prepared to present evidence that you were not at fault. Your insurer will send you a Notice of At-Fault Determination. You’ll need to make sure that all the information in the document is correct or you’ll have to send it back to your insurance company for correction.

If you need assistance with appealing a car insurance company decision about a 50/50 car accident, you can reach out to your state’s department of insurance, which can be easily located thanks to this National Association of Insurance Commissioners map.

What question should I ask my insurance adjuster after an accident?

Another thing you might want to do after an accident is to ask questions about your car insurance policy and how the accident will affect you afterwards.

Here are some general questions:

- Does my car insurance cover this accident?

- How will this accident affect my car insurance rates?

You can ask your insurance adjuster whatever questions you like. It would be a good idea to brainstorm ahead of time and write down all of your questions so you don’t forget anything when you talk to the adjuster. Sometimes being blamed for an accident is inevitable. But only having to take responsibility for half is better than being completely at-fault. We hope you learned a lot about 50/50 car insurance claims from this guide.

Enter your ZIP code below to compare car insurance company rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.